Meet Frozan, who has created a buzz around Marmul

Frozan, 18, lives in north Afghanistan, a corner of the world where opportunity is scarce. Still, that never stopped her from dreaming. “We are a big family and my father, a farmer, was the only one earning – it was never enough. I have always wanted to do something to help but I didn’t know how.”

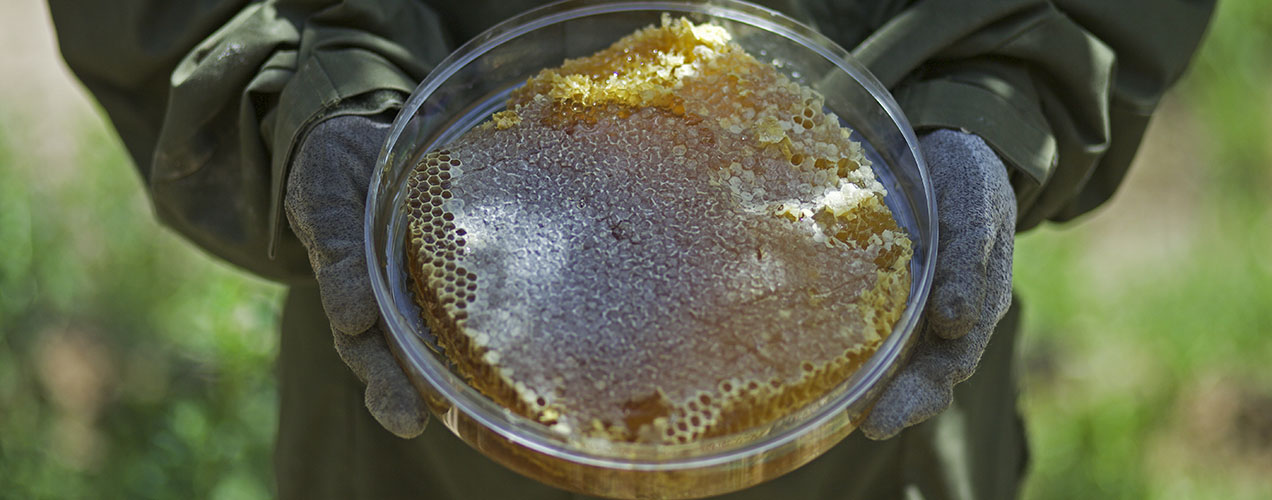

Didn’t, that is, until she met Hand in Hand. Frozan joined a Self-Help Group and quickly became a star pupil. Training led to a business plan, which led to a loan from fellow group members. Finally, she was ready: the newest and youngest beekeeper in her village. Her business has not only helped put her through school, but it has done the same for her younger siblings and even helped her parents provide for the family.

Mazar-i-Sharif, Balkh Province, Afghanistan

Keeping busy

As a student, Frozan had already achieved more than her peers, but a desire to help her family would not let her stop there.

After joining the Shogufa SHG, Frozan attended regular meetings and supplemented her schoolwork with training on microfinance, bookkeeping and business development.

“I was keen to have a business from the first group meeting until I completed [business development] training, when I understood how to run a business and what I should consider before starting a business,” Frozan said. “Therefore, with the help of my trainer, I developed a business plan.”

Frozan carried out a study of the Marmul district in the Balkh province in northern Afghanistan and learnt that there was a high demand for honey. After further research, she discovered that beekeeping doesn’t require much labour – a perfect arrangement for a full-time student – and so she applied for and obtained a microloan of 10,000 afghanis (US $140) so that she could purchase two boxes of bees.

Sweet success

As the youngest person in Marmul to keep bees, the SHG taught Frozan the skills she needed to look after them, as well as how to extract the honey and improve its quality and volume.

After her first year, she had harvested 16 kg (35 lbs) of honey, making enough to not only repay the microloan but to leave her with a small profit. She invested that back into her business by buying more bees, and last year, she earned 120,000 afghanis ($1,728) from the 120 kg (265 lbs) of honey produced by a collection of what had grown to 20 beehives.

“After first year of my business, I was amazed to see the results,” Frozan said. “I repaid the loan and expanded my business. Now I am paying school expenses of my two younger siblings, helping my dad in home expenses and I have my own savings for emergencies.”

Frozan’s classmates have told her they have been inspired by her business and that they would like to set up their own.

“People having a business like me can help their families to overcome financial challenges, save for emergencies and take active part in developing economy of their communities,” she said.

“Now I have learnt how to manage my activities and time, and work confidently in order to improve our lives. I am also saving for expanding my business, which will in turn generate more income for me in the future.”

Frozan’s results

Increased monthly income from 0 to 10,000 AFN (US $144)

Able to contribute to school fees for her siblings

Inspired classmates to create their own businesses

Meet Bernhard, the entrepreneur with a micro-business empire

Two years ago, Bernhard was running a small photocopying and computer skills training business out of his rented house. Today he has a studio in a home he owns, employs two family members in his sweet potato farming business and part-owns a community billiards room that funds a profitable pig farm. And he’s not stopping there.

An uncertain future

Young people in Kenya face many problems. Quality education is rare and expensive. Disease, including HIV, is highly prevalent, and cultural stigma often prevents you from seeking help. And even if you graduate with your health intact, Kenya’s youth bulge means competition for entry-level jobs is fierce beyond imagination, and youth unemployment rates are some of the highest in the world.

Based in rural Embu County, Bernhard is one of the many young people who refuses to let adversity stop him. Ambitious, hardworking and full of entrepreneurial spirit, he established a small photocopying business in 2014 and taught basic computer skills on the side. He joined Hand in Hand a year later, seeing an opportunity to grow his business, and is now a part of a Self-Help Group made up of similarly eager young people.

Embu, Kenya

Building an empire

With their training complete, the group devised a plan that would generate money quickly. Pooling their savings, they bought a pool table and rented a room for it in the local shopping centre. It now provides a total profit of KES 10,000 (US $100) a month – and also keeps teenagers out of trouble. “When they are gathered there together, they concentrate on one thing. So it’s difficult for them to start thinking about crimes,” says Bernhard.

The impressive income generated by the community pool table has allowed Bernhard his group to invest in a bigger project: a farm with 10 pigs, which they believe will yield a long-lasting and sustainable income.

‘I decided to be unique’

Yellow sweet potatoes

Bernhard has also used his training to improve his own business, saving up the coins he earns from photocopying. Eager to invest, he researched which crops were most profitable and eventually bought a crop of yellow sweet potato vines, employing his mother and sister to help plant them.

Despite their popularity, sweet potatoes are not commonly grown in the area. “Here people don’t value sweet potatoes very much because they think it’s an indigenous plant, so they see it as a common thing. They think they are planted by old people, rather than farmers outside Embu County,” he says. “I decided to be unique.” Bernhard capitalised on a gap in the market, and is now reaping the rewards of his ingenuity.

“Before Hand in Hand – let me be frank – I was not very successful,” he continues. “After selling my sweet potatoes, I have managed to buy a picture printer that costs 24,000 KES (US $240), and I introduced a studio inside my room.”

Between his sweet potatoes and the income generated by his technology business, he has been able to build his own home and provide for himself and his new wife.

And his next big purchase? “A sofa set for the house.”

Bernhard’s results

Owns or part-owns 4 businesses

Employs 2 family members

Bought house

Meet Zubaida, the ‘famous’ tailor from Marmul district

Four years ago, Zubaida had no job and no income. Today, she’s something of a local celebrity, “famous” for running her own tailoring business. With her newfound income, the 32-year-old is feeding her children a more nutritional diet. And with her growing reputation, she’s training six people in her community to work as tailors, just like her.

The Gul Lala Self-Help Group

Employment in Afghanistan is hard to come by. Poverty is not. Some 39 percent of Afghans live on less than US $1.90 a day, the World Bank’s threshold for ‘extreme poverty’.

Zubaida used to be one of them. Back in 2014, she was struggling to feed her five children with her family’s monthly income of AFN 7,000 (US $100). So when Hand in Hand Afghanistan offered her the chance to learn business skills as part of a Self-Help Group, she leapt at the chance.

Hand in Hand’s budding entrepreneurs are offered the chance to learn basic business skills, form a community and build a pool of savings that can be used to take their initiatives further. Zubaida joined the Gul Lala Self-Help Group and did exactly that, taking an initial loan of AFN 10,000 (US $200) to establish her own tailoring business after gaining the training and confidence she needed.

Entrepreneurial pursuits

Zubaida serves her daughter lunch

Today, Zubaida designs, makes and sells women’s clothes for AFN 200 to 450 (US $3 to $7) an item, while the clothes she makes for children fetch AFN 150 to 200 (US $2 to $3). Between them, she earns about AFN 6,000 (US $85) a month.

But the impact of her new enterprise isn’t only financial. “Now I’m able to make decisions about my kids and describe my views and opinions in a better way with my family members,” she says.

And her sense of empowerment doesn’t stop there. “My neighbours and relatives see me as a businessperson and as an instructor, which makes me proud,” says Zubaida. “My enterprise has made me famous and it has given me the courage to take part in social activities.”

Having paid her loan back to the group, she is now training six people like her in tailoring entrepreneurship. Not only has her business allowed her to build financial freedom and confidence, it has given her a platform to train and inspire others to improve their own lives.

Zubaida’s results

Monthly income: AFN 6,000 (US $100)

Training six members of her community

Feeding her five children healthier meals

Meet Manimozhi, grinding away for her family’s future

By Shivani Kochhar

With a grandchild on the way, Manimozhi needed funds fast. Her family business, a flour mill, was failing. But without capital and expertise she couldn’t change her fortunes.

A new family member

Manimozhi wanted to give her grandson the best start in life; in Pondicherry, this means being born in a private hospital. Only 1.2 percent of Indian gross domestic product is spent on public healthcare, and many government hospitals lack basic standards of hygiene, particularly in rural areas. For people like Manimozhi, they are an absolute last resort.

Pondicherry, India

Becoming a businesswoman

Manimozhi joined a Hand in Hand Self-Help Group with the hopes of using her loan to pay for the costs of the birth. Instead, after receiving training in financial literacy, she ploughed the loan into the faltering mill business she’d inherited from her father and paid for the birth using pure profit.

Manimozhi joined a Hand in Hand Self-Help Group with the hopes of using her loan to pay for the costs of the birth. Instead, after receiving training in financial literacy, she ploughed the loan into the faltering mill business she’d inherited from her father and paid for the birth using pure profit.

Manimozhi’s mill grinds rice, wheat and grains into flour or oil. It’s bring your own grain: customers are only charged for the grinding service. Using her loan, Manimozhi modernised the mill with an automated elevator that feeds paddy into the mill more quickly, speeding up production. Now, customers travel for 30 minutes by tractor to come to the mill. “I’ve opened my own private bank account so I can save better,” she says.

Keep calm and carry on

Those savings came in handy when the mill was damaged, its roof torn clean off, during a severe statewide storm that killed almost 50 people in Pondicherry and nearby Tamil Nadu. The cost of rebuilding was IRN 50,000 INR (US$ 766). With her savings in store, Manimozhi wasn’t held back: she got on with the rebuild quietly.

Manimozhi’s is now the longest standing flour mill in the area. The business has been in the family for 55 years and is already providing for two more generations. She now knows how to support her family through the good times and the bad.

Manimozhi’s results

Employs 4 staff members

Pays for grandchildren’s education

Supports 3 generations of her family

Meet Komala, who’s bringing beauty back into business

By Shivani Kochhar

Running her own beauty salon had been a dream of Komala’s since childhood, but lacking education and in her mid-30s, she was a housewife living on the brink of poverty instead.

The ugly truth

In India, one in five people are considered ‘poor’, living on less than $1.90 a day. This is partly due to the nature of employment: only 17 percent of jobs are salaried and one-third are irregular. Women looking for work have even more hurdles to overcome as there is large gender gap in the workforce. Just 27 percent of women participate in the labour force at all, compared to 79.1 percent of men. Clearly, the odds were against Komala – so she decided to take matters into her own hands.

Transformation

Things changed for Komala when Hand in Hand arrived in her panchayat. Inspired by her Self-Help Group’s promise of beautician training, not to mention a loan to get her started, she soon finished her training and opened up shop. With four beauty salons nearby already, she established a competitive advantage based on comparatively low prices and superior customer service. She is especially busy during wedding season when everyone needs to be pampered to perfection.

“Some of my neighbours have been motivated to start up a business of their own,” she says.

A touch of sparkle

Even with business humming, Komala found she had downtime during the day. That’s when she established a side-business embellishing saris with sequins and embroidery that now accounts for 30 percent of her income. But she wasn’t done there. Sensing opportunity, Komala qualified to become a beauty trainer herself, and today teaches up to 20 students a month. She earns INR 1,000 (US $15) per student and gets the satisfaction of helping other women start their careers. “Even though I am training members of my community, they see me as a professional,” says Komala.

Pondicherry, India

Looking forward

Together, her three streams of income bring in an average of INR 51,600 (US $770) a month. That’s enough to pay for life-changing appliances including a refrigerator and air conditioner. She can also afford some luxuries such as a TV. Next up: Komala is saving to buy a permanent home for her family and, when they grow up, pay for her two children’s university. “I hope that my son will become a doctor,” she says.

And her plans for her business? “I want to brand my salon with my own name, to make it stand out from others in the neighbourhood.” Sounds like a winning idea to us.

Komala’s results

![]()

Earns INR 51,600 (US $770) a month

![]()

Able to give her children a university education

![]()

Helps the community by teaching her skills to budding beauticians

Meet Jagadeeswari, the spice-seller with SME status

By Shivani Kochhar

Jagadeeswari could give any entrepreneur a run for their money. Five years ago, she was distributing her spices as free samples to neighbours and her business was making a loss. Fast-forward to today and she has won a state prize for ‘First-Generation SME Entrepreneur of the Year’. Her distribution network spans 200 shops across her home state of Tamil Nadu, and she sends her spices as far away as Malaysia. It’s a homegrown business gone global, and an unlikely success story in a state where 22.5 percent of people live below the poverty line, earning less than US $1.90 a day. Jagadeeswari’s successes are an exception to the rule rather than the norm – something that Hand in Hand aims to change.

Pondicherry, India

The perfect blend

Jagadeeswari flourished at her Hand in Hand Self-Help Group. The energetic 46-year-old is a natural leader, and her fellow group members quickly selected her to be in charge. Jagadeeswari started selling her spices at food fairs and managed to grow her client base district-by-district until she had established a state-wide network. Recognising her potential, Jagadeeswari’s Hand in Hand trainer provided her with special training in bookkeeping and packaging.

“Joining the Self-Help Group changed my life totally,” says Jagadeeswari, who now produces a range of around 40 all-natural spices and food products. She is the only producer in town with such a wide range of condiments.

Sugar and spice

Jagadeeswari wanted to increase her product range and hit a winner: Sarpath. A refreshing all-natural sweet soda, it’s perfect for washing down all those spices. Now she earns 35,000 INR (US$ 525) every month in pure profit. She also employs five staff including her husband, who helps with marketing and sales. He’s pleased for Jagadeeswari: “I’m very happy about my wife’s success.”

Jagadeeswari wanted to increase her product range and hit a winner: Sarpath. A refreshing all-natural sweet soda, it’s perfect for washing down all those spices. Now she earns 35,000 INR (US$ 525) every month in pure profit. She also employs five staff including her husband, who helps with marketing and sales. He’s pleased for Jagadeeswari: “I’m very happy about my wife’s success.”

Woman power

As business is booming, Jagadeeswari has bought a separate building for her work and invested in a packing machine. Besides her husband, all her employees were formerly housewives and members of her Self-Help Group. Most importantly, the income generated from her spice business finances her son’s architectural training. Investing in her son’s education has already paid off – he helps her to do her marketing and created a website for the business. Jagadeeswari‘s children now call her “mother role model”. She’s their inspiration.

As for her Entrepreneur of the Year award, Jagadeeswari says she’s happy for the publicity – as long as it attracts new clients. Clearly, she never stops being the businesswoman.

Jagadeeswari’s results

Earns 35,000 INR (US$ 525) net profit per month

Sends her son to architectural school

Achieved SME level status

Meet Savitah from Kanchipuram, who’s gone from paper dreams to paper plates

By Shivani Kochhar

Savitah’s paper-plate business was making no profit at all. The 26-year-old newlywed had little experience of business. But she did have a drive to succeed.

A woman on a mission

Savitah was inspired by her friends in Bangalore to go into business. Most of all, she admired the bravery of these female entrepreneurs for breaking the status quo: just 27 percent of women participate in the labour force at all, compared to 79 percent of men. Savitah initially attended a Self-Help Group to finance a paper-plate-making machine. One thing led to another: she completed bookkeeping training and realised that 85 percent of her total costs went on raw materials, preventing her from making a profit.

Savitah put every effort into sourcing cheap materials, knowing they could make or break her business, searching as far afield as Delhi (2,200 km away). In the end, she managed to find a supplier much closer to home in Chennai.

The secret to success

Today Savitah consistently undercuts her competitors – and watches her sales soar. With her savvy sourcing, she maintains a healthy 27 percent profit margin. This is boosted by the sale of off-cuts to paper merchants who use them to make recycled paper. It’s business-smart and environmentally sustainable. Her monthly net income, once zero, is now 21,500 rupees (US $350).

Kanchipuram, Tamil Nadu

Independent woman

Most of Savitah’s income has been reinvested in the business, but she keeps a little for herself so she can feel more independent in her daily life. “When I leave the house now, I don’t need to ask my husband for money,” she says.

Her husband questioned the need to buy a second machine but Savitah’s reasoning was as simple as it was compelling: “Anyone who buys a paper bowl will also need a paper plate, so let’s buy that machine, too.” Although she’s an entrepreneur at heart, Savitah says, “Before joining the Hand in Hand group, I would not have been confident to make a decision like that on my own.”

Team leader

Savitah exudes a quiet confidence and determination, and since she first joined the group she’s persuaded five new members to join. Her peers chose her as their group leader, a role that entails managing meetings, teaching basic business skills and encouraging members to start their own businesses. A fast learner herself, she observes: “Sometimes it takes members so long to get up to speed with the concept; you have to be patient until they understand the approach.”

A working mum

Now 31, Savitah is expecting her first child but is confident that she will continue on her path as an entrepreneur and group leader. “I enjoy being independent and helping others to be independent, too,” she says.

Savitah’s results

Earns 21,500INR (US$ 350) net income per month

Voted to be the leader of her Self-Help group

Has financial independence

Meet Zacharie, the salesman from Rwinkwavu

Ambition, the gift of gab, a relentless work ethic – Zacharie Itegekaharmde has all the traits of a born salesman. What he didn’t have was capital.

Then he found Hand in Hand.

Limited progress

Until a few years ago, Zacharie lived with his brother and elderly mother as one of the almost 80 percent of Rwandans who farm for a living, many at the subsistence level. Stuck on a cramped plot in the Eastern Province village of Rwinkwavu, the family struggled to eat three meals a day. “The farming was just for survival,” he says. “We could not get enough food to eat. We used to make and sell banana beer so that we could afford to buy clothes.”

Rwanda has come a long way since the 1994 genocide claimed some 800,000 lives. The country made “especially impressive progress” on a number of UN Millennium Development Goals, particularly in the areas of extreme poverty reduction and primary school education. But there remains a hugely long way to go. On the UN Human Development Index, for example, Rwanda ranks a sobering 158 of 189.

Sell phones

Life changed the day a sceptical Zacharie was persuaded by friends to join a Village Savings and Loan Group established by Hand in Hand partner organization CARE. To his surprise, admits the 25-year-old, the training was interesting. Better still, it was useful. “You learn that if you get a loan it is not to solve your problems but to make money,” he says. That’s exactly what he’s doing.

Life changed the day a sceptical Zacharie was persuaded by friends to join a Village Savings and Loan Group established by Hand in Hand partner organization CARE. To his surprise, admits the 25-year-old, the training was interesting. Better still, it was useful. “You learn that if you get a loan it is not to solve your problems but to make money,” he says. That’s exactly what he’s doing.

The Rwandan telecoms market is exploding. Between 2005 and 2010, the number of families with at least one cellphone grew 39 percent, climbing past 45 percent from only 6.2. By 2013, cellphone penetration countrywide was more than 61 percent.

Zacharie didn’t need business training to spot the opportunity. In fact, he’d been selling cellphone products on the side for years, making all but enough to invest and expand. Getting a loan from his savings group was easy enough. Pitching South African telecom company MTN for an exclusive airtime card distribution deal was harder. But armed with the skills he’d learned in his group from a Hand in Hand trainer, Zacharie pulled it off. Today his ‘patch’ spans a 125-mile radius, an area so big he’s had to hire help. Even better, his income has skyrocketed to 110,000 Rwandan francs (US $160) a month – almost three times the monthly national average of 37,000 RWF (US $55).

The resulting lifestyle change has been immense. Not only has Zacharie built a brick home, he’s furnished it – just in time for his upcoming wedding.

Zacharie’s results

![]()

Increased monthly income to 110,000 Rwandan francs (US $160)

Hand in Hand Eastern Africa and CARE Rwanda are co-operating to empower some 100,000 Rwandans, mostly women, to work their way out of poverty by running their own sustainable businesses. The three-year, US $3.2 million partnership is grounded in our shared belief in the power of entrepreneurship to fight poverty.

Meet Parvathi, the glove manufacturer from Tamil Nadu

With three children, one employee and a fast-growing business, Parvathi is the archetypal Hand in Hand entrepreneur. There’s just one difference: more than anyone we’ve met, the 52-year-old proves that it pays to invest in your children’s education. Literally.

Parvathi joined Hand in Hand and quickly set about establishing a knitting and embroidering enterprise. It wasn’t wildly successful, she says, but it earned enough to help put her children through university. Business was humming along fine when, a few years back, her son got his first job as an engineer – and along with it his first pair of protective gloves. And his second. And his third. Shocked at the quantity of gloves his workplace devoured, Parvathi’s son suggested she start a new line of business: manufacturing protective gloves. The switch wouldn’t be easy. For one, she would need to import an INR 500,000 (US $8,300) machine from Japan. But as a Hand in Hand Self-Help Group member for eight years, Parvathi knew where to turn.

Rural unemployment

Women entrepreneurs face huge barriers in India. According to the International Labour Organization the country ranks 120 out of 131 in women’s labour force participation. Rurally, barely one in three women work – 19.5 million fewer than just five years ago. The numbers are borne out in Tamil Nadu, the southern India state Parvathi calls home. More than 20 percent of residents here live below the poverty line, most of them rural. Access to credit can make all the difference.

Parvathi’s neighbourhood

Breaking the thatched ceiling

Parvathi borrowed the money from her group, imported the machine from Japan and got to work. Although her expenses had grown – materials had to be in ordered in bulk from Coimbatore almost 500 km away – so too did her profits. Parvathi now owns two knitting machines yielding INR 176,000 (US $2,900) a month, INR 54,800 (US $912) in pure profit. Loans to buy two more are pending.

“Ten years ago, I was even scared to go out of the house and speak to anyone,” she says. “Now I have even learned how to speak with bankers.”

Parvathi’s self-confidence isn’t the only thing to have improved. Where once they shared a one-room thatched-roof hut, Parvathi’s family now live in a brand new concrete home. For the first time, the future looks bright.

Parvathi’s self-confidence isn’t the only thing to have improved. Where once they shared a one-room thatched-roof hut, Parvathi’s family now live in a brand new concrete home. For the first time, the future looks bright.

“I want to safeguard the future of my children with this business,” says Parvathi. And indeed she has. Only a year after starting his career as an engineer, Parvathi’s son is coming to work for the family business. The opportunities, he’d told her, are better.

“I worked hard and they rested,” she says. “Now it is my turn to rest and theirs to work”.

Parvathi’s results

Meet Florida, the young mother saving to put her children through school

So often, beneficiaries in the developing world are reduced to cold numbers. But ask Florida Mukarugema what’s been the biggest change since she opened her shop and her answer won’t fit on any graph. “I am feeling happy. I am no longer crying.”

Florida joined a Village Savings and Loan group organised by Hand in Hand field partner CARE in 2009, driven, like so many others, by sheer desperation. “We used to eat just once a day, in the evening. We didn’t have our own home but stayed with others. I couldn’t even afford a bunch of bananas,” she says.

How things have changed. Today, bananas are Florida’s bestselling item, the staple around which the young mother built her growing business, which also sells rice, maize flour and more. Recently, with help from a Hand in Hand business trainer, she borrowed 108,000 Rwandan francs (US $158) to build a water facility and sell clean water. Tally her earnings from both and Florida’s annual income is 1,200,000 RWF (US $1,760), almost ten times what she made previously and three times the gross national income per capita.

A country rebuilds

Life in Rwanda has improved beyond description in the 20 years since genocide convulsed the country, claiming some 800,000 lives in just 100 days. The economy is growing at upwards of 8 percent a year. Rwanda was- “top-performing” at the Millennium Development Goals, according to the UN. Social progress, evinced by the world’s greatest proportion of women MPs – 64 percent – has been undeniable. And yet there remains a hugely long way to go.

Florida’s neighborhood

Rural Rwanda, home to Florida’s Eastern Province village of Kinamba, experiences three times more poverty than urban Rwanda. Countrywide, more than 80 percent of Rwandans are engaged in agriculture, many at the subsistence level. And almost a third of Rwandans are considered undernourished by the International Food Policy Research Institute.

Savings and loans

Florida was one of them. Then she borrowed 15,000 RWF (US $22) from her Village Savings and Loan group and bought three bundles of bananas, which quickly sold for 28,000 RWF (US $41). Buoyed by a series of ever-bigger successes, Florida went on to borrow 200,000 RWF (US $294) from her group to open a shop.

“Before I joined the group I was not even able to buy salt,” she says. “I did not know how to use the bank and I did not understand how to buy and sell and make a profit.”

Today, Florida, her husband and the couple’s four children – two of whom are adopted – live in a furnished three-room home with clean water. “I will make sure they go to university and then live in a nice place,” she says.

Florida’s results

Annual income of 1,200,000 RWF (US $1,760) – 10 times her previous income

200,000 RWF (US $290) in savings

Saving to pay for children’s university fees

Hand in Hand Eastern Africa and CARE Rwanda are co-operating to empower some 100,000 Rwandans, mostly women, to work their way out of poverty by running their own sustainable businesses. The three-year, US $3.2 million partnership is grounded in our shared belief in the power of entrepreneurship to fight poverty.