Hand in Hand a ‘centre of excellence’, says review

07 Oct 2016

Hand in Hand Eastern Africa is a “centre of excellence in training and transforming of Self-Help Groups”.

That’s according to an independent review published by the Abymas Development Practices Centre, a Zimbabwe-based evaluation agency, and funded by the Swedish International Development Cooperation Agency (Sida)/the Swedish Embassy in Nairobi.

The review comes off the back of a two-year, SEK 20 million (US $2.3 million) programme in Kenya, which concluded in March and aimed to achieve three broad objectives:

- To provide business training and marketing support to rural entrepreneurs, resulting in 14,000 jobs.

- To provide Self-Help Group members with access to microfinance.

- To promote green jobs and environmental resilience in partnership with the Government of Kenya’s Agricultural Sector Development Support Programme (ASDSP).

Here’s what it found.

Business training and enterprise development

“The effect of the project in reducing the number of people living below Ksh 3,000 (US $30) has been phenomenal,” concludes the review.

The result was achieved as members moved from subsistence farming into different agricultural value chains such as dairy, while others moved into retail, services, arts and crafts and more.

Retail and services were the two most lucrative types of enterprise, resulting in average monthly sales of Ksh 21,754 (US $217) and Ksh 19,156 (US $191) respectively.

“The Hand in Hand Eastern Africa model of enterprise development and job creation is unique”, the report concludes, “in that it creates a strong foundation for target groups to immediately use knowledge and skills gained to identify enterprise opportunities with the reach of individual entrepreneurs before even receiving external financing.”

By the numbers

67% of members were engaged farming at the outset of the project. Two years later, that number was down to 48%

67% of members were engaged farming at the outset of the project. Two years later, that number was down to 48% At the same time, the proportion of members working in retail and services rose from 7% to 23%

At the same time, the proportion of members working in retail and services rose from 7% to 23% 56% of members earned less than Ksh 3,000 (US $30) per month at the outset of the project. By the time it concluded, that number had decreased to only 15%

56% of members earned less than Ksh 3,000 (US $30) per month at the outset of the project. By the time it concluded, that number had decreased to only 15% At the same time, the proportion of members earning Ksh 10,000 (US $100) or more per month jumped from 9% to 27%

At the same time, the proportion of members earning Ksh 10,000 (US $100) or more per month jumped from 9% to 27%Gender, social inclusion and culture

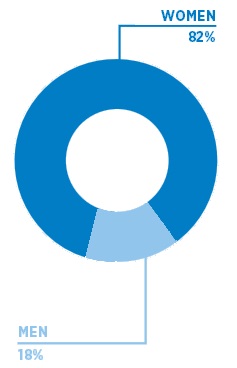

Hand in Hand contributed “significantly to reducing gender inequality in the social and economic life of rural communities in all the targeted geographical areas,” says the report.

Before the project, “most women met during field work pointed out that their life was miserable and hopeless… as they were just working on isolated home activities for survival.” Today, “women have shown confidence in every possible sector,” resulting in “great household resilience, which changes the employment and income dynamics within the household within a very short time.”

Men’s attitudes also changed, “becoming more supportive of women’s participation in SHG activities and viewing women as equal partners in the decision-making process.”

Environmental resilience and green business

Members were “instrumental in championing key environmental initiatives within their households and communities” despite facing “several challenges”, said the report.

Barriers to success included entrenched attitudes and the cost of environmentally friendly technologies. But initiatives including “tree nurseries… stoves for energy saving, waste recycled products in peri-urban areas, water management and conservation, improved sanitation and use of organic manure” proved popular nonetheless, helping members build resilient, sustainable enterprises.

More intensive training and deeper linkages with similar projects were recommended to improve the programme.

Access to microfinance

Hundreds of members borrowed microloans from Hand in Hand Eastern Africa’s Enterprise Incubation Fund (EIF) to help grow their businesses. So far, so good.

At the end of the lending cycle, however, relatively few showed interest in climbing the finance ladder to receive higher interest loans from bigger, more formal lenders – one of the fund’s chief goals. That could spell trouble when the project concludes.

The report suggests two possible solutions.

- Work more closely with microfinance institutions and government agencies to ease members’ climb up the microfinance ladder.

- Provide two distinct types of loans: one for start-ups, another for businesses able to demonstrate market-driven growth. “This will ensure those entrepreneurs that are not growing are churned out at a pre-determined exit point within the loan cycle. At that point they will have acquired entrepreneurship skills, knowledge and experience and will have developed strong mutual support systems (internal savings) that can propel them into the future,” says the report.