Beyond Savings: Towards Inclusive Growth

A Seminar at the London School of Economics

Who: Hand in Hand International welcomes experts from the fields of financial inclusion and job creation. Scroll down for a full list of speakers.

When: 5 December 2016, 16.00-20.00

Where: The London School of Economics, Vera Anstey Room, Between ground and first floor, Old Building, Houghton Street, WC2A 2AE

What: Featuring short presentations from a series of speakers, this seminar will explore evidence-based solutions to the lack of capital and training that hinders women entrepreneurs in the developing world. It will consider three complementary efforts, each focused on a single aspect, but all necessary to achieving the ultimate goal: financial inclusion; the creation of sustainable jobs; and the development of micro-, small- and medium-sized enterprises.

Chair: Myles Wickstead, CBE

Myles Wickstead is a Visiting Professor (International Relations) at King’s College London. From 1997 to 2000 he served on the Board of the World Bank in Washington, and was Britain’s Ambassador to Ethiopia and Djibouti from 2000 to 2004.

Laurie Lee – CEO, CARE UK

CARE developed the Savings Groups model in the early-1990s to close the credit gap among Niger’s rural poor. CARE UK CEO Laurie Lee considers savings groups, loans and financial inclusion for women and small women-owned businesses.

Josefine Lindänge Gutman – CEO, Hand in Hand International

From 2013 to 2016, Hand in Hand and CARE Rwanda teamed up to provide intensive business training to 130,000 Savings Group members. The partnership produced some hugely promising results, including a 75 percent increase in members’ average monthly incomes. As Hand in Hand prepares to expand in Tanzania, CEO Josefine Lindänge Gutman makes the case for business training achieved through partnerships.

Niclaus Bergmann – Managing Director, Savings Banks Foundation for International Cooperation (SBFIC)

Based in Bonn, SBFIC is the foundation of the largest banking group in Germany, with projects in Asia, Africa, Latin America and the Caucasus region. Group Managing Director Niclaus Bergmann discusses the importance of strengthening financial inclusion from a supply perspective.

Laura Hemrika – Head of Corporate Citizenship & Foundations, Credit Suisse

Corporate Citizenship is Credit Suisse’s social commitment to enable inclusive growth, with a focus on education, microfinance and other key sectors. Credit Suisse Head of Corporate Citizenship & Foundations Laura Hemrika will speak about the experience of MFIs extending credit and financial education to women.

Financial inclusion

Up to 70 percent of women-owned businesses are un- or underserved by financial institutions, according to estimates. In some cases a lack of collateral or scant borrowing histories are to blame. In other cases entrenched cultural and social obstacles get in the way. Meanwhile, financial institutions have difficulties in assessing risk and managing the high transaction costs of micro-loans.

Up to 70 percent of women-owned businesses are un- or underserved by financial institutions, according to estimates. In some cases a lack of collateral or scant borrowing histories are to blame. In other cases entrenched cultural and social obstacles get in the way. Meanwhile, financial institutions have difficulties in assessing risk and managing the high transaction costs of micro-loans.

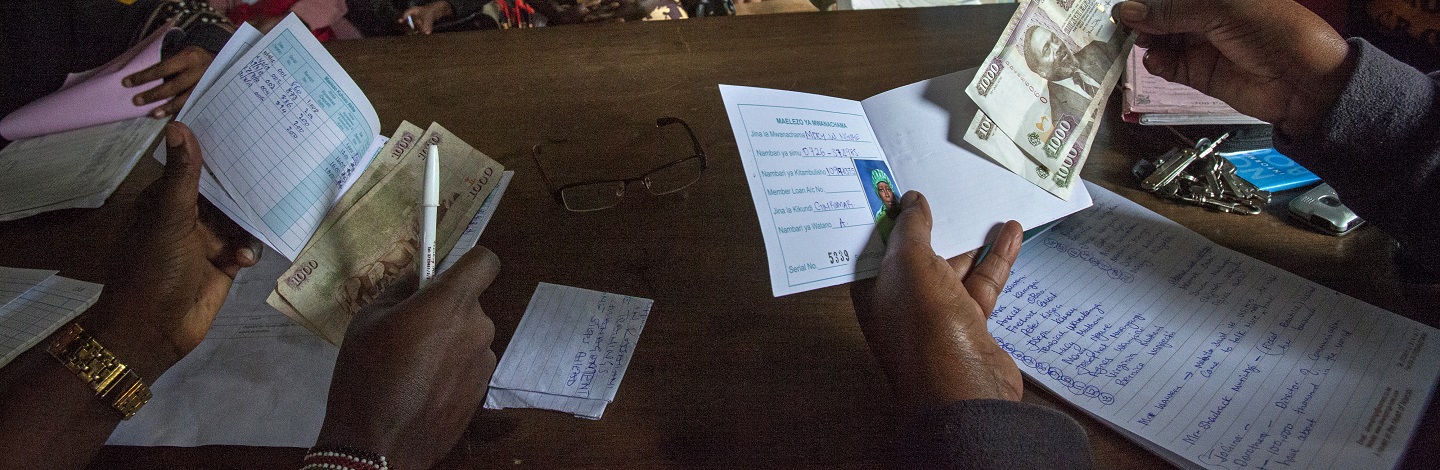

The CEO of CARE International UK, Laurie Lee, will discuss the progress of CARE’s programmes to promote financial inclusion for women and women-owned small businesses. CARE was a pioneer of Village Savings and Loan Associations (VSLAs), which now have more than 4 million members. Since 2009, CARE has initiated new programmes extending basic financial services to VSLA members and improving the products and services offered to the poor.

Job creation

Those in poverty do not lack initiative or energy; they lack opportunity. Hand in Hand International works

Those in poverty do not lack initiative or energy; they lack opportunity. Hand in Hand International works

with the poor – predominantly women – in Africa and Asia to unlock entrepreneurship potential and help them to find a way up and out of poverty. Hand in Hand does this by providing business training, financial literacy, product development and market linkages.

Hand in Hand International CEO Josefine Lindänge Gutman will outline findings from a recent evaluation of a successful joint Hand in Hand-CARE project in Rwanda that aimed to create 80,000 sustainable jobs for women. The project resulted in significant increases in productivity and profitability among members – and an average rise in monthly income of 75 percent versus other VSLAs that did not get the training. Rwanda is an informative case study given the high level of female participation in the labor force and the government’s commitment to entrepreneurship and financial inclusion.