Give a loan, not a grant

Contribute to Hand in Hand’s Enterprise Incubation Fund and you’ll help thousands of entrepreneurs work their way out of poverty

Traditional banks don’t make loans to subsistence farmers and teenage mums. Nor, for that matter, do most microfinance institutions, which typically require at least some kind of asset collateral. Hand in Hand’s Enterprise Incubation Fund is there to pick up the slack.

The fund is predicated on one simple truth: savings groups and skills training go a long way towards eradicating poverty, but they aren’t always enough. Without access to finance, most micro-entrepreneurs will never be able to expand their enterprises and lift themselves out of poverty.

That’s why, amidst calls to end poverty and hunger, the UN Sustainable Development Goals spell out the need to “strengthen the capacity of domestic financial institutions to… expand access to banking and financial services for all”.

India

Parvathi | Gloves manufacturer | Kanchipuram, India

Hand in Hand India has facilitated access to more than US $977 million in microloans since 2006. In 2012, specialist microfinance consultancy M-CRIL – employed by the World Bank, DFID and others – carried out an in-depth study, interviewing 2,558 members of Hand in Hand Self-Help Groups. The study confirmed that credit facilitated by Hand in Hand India benefits some of society’s most disadvantaged women.

Thanks to ongoing mentoring and business training, loans are used productively: more than 95 percent of women were found to have invested 90 percent of loan values into their businesses. Repayment rates surpassed 99 percent. What’s more, jobs were both sustainable and catalytic.

Top results

Total distributed: US $348 million

Repayment rate: 99%

Jobs created: 4.77 million

Kenya

Established in 2013, Hand in Hand Eastern Africa’s EIF provides microloans, typically worth about US $120 each, to graduates of our training component. Global accountancy firm Parker Randall independently evaluated the fund in December 2014, confirming 95 percent repayment rates, across the board, for the entire duration of the EIF.

Intense financial skills training and our strict system of group guarantees were credited with producing the result – impressive even in comparison to many Western funds. In the UK, for example, the government’s Finance Guarantee Scheme for small-to-medium sized enterprises has a default rate of 11.9 percent.

Work is ongoing to improve and diversify the EIF’s capital base by seeking new partners and expanding existing relationships. In 2015, Hand in Hand Eastern Africa established a KSH 10 million (US $100,000) partnership with Safaricom, Kenya’s leading telecommunications company, that put KSH 7 million (US $70,000) into the fund. Meanwhile, the EIF’s relationship with crowdfunding pioneers Kiva continues to grow, having reached a credit limit of US $400,000.

Number of loans: 73,956

Total distributed: US $8.79 million

Repayment rate: 99%

Meet Jane

Jane Muindi, 59, joined Hand in Hand as a subsistence farmer. Having completed our training – covering savings management, enterprise development, financial management, value chain management and more – she emerged as an entrepreneur with a plan. What she lacked was capital.

Jane Muindi, 59, joined Hand in Hand as a subsistence farmer. Having completed our training – covering savings management, enterprise development, financial management, value chain management and more – she emerged as an entrepreneur with a plan. What she lacked was capital.

That was before she signed on to the Enterprise Incubation Fund. With her first two loans – worth KSH 15,000 (US $150) and KSH 10,000 (US $100); both paid off – Jane expanded her subsistence farm into a profitable business with mixed crops and multiple employees. With her third loan, worth KSH 25,000 (US $245), she started a general store selling her crops and other food.

“I thank Hand in Hand Eastern Africa and my group for giving me the loans that I used to add stock of sugar, sodas drinking water and unga,” said Jane. “In a day, I make sales of KSH 700 (US $7) and my profit from this is KSH 300 (US $3). With my increased income I was able to take my child to college.”

Reasons to lend

High repayment rates

High repayment rates

Borrowers receive continuous mentoring from Hand in Hand Eastern Africa trainers, resulting in repayment rates of 100 percent.

Reaching more people than with a grant

Because funds are loaned to multiple entrepreneurs over the course of a five-year term, every US $1,000 funded generates at least US $5,000 in loans.

Lending to those who need capital the most

More than 60 percent of Hand in Hand Eastern Africa micro-entrepreneurs support their families on KES 1,100 (US $13) or less per week. Half lack access to running water, and one in three live in huts made of mud or corrugated iron.

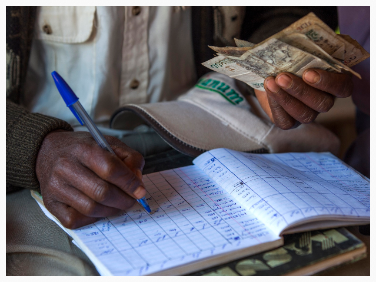

Kanyoni Self-Help Group treasurer | Outskirts of Thika, Kenya

Addressing a gap in the market

Microfinance is widely available in Kenya, but not to the rural poor. Our microloans start from as low as KES 5,000 (US $60) and, restricted to one per person, are used purely as catalytic start-up capital, bridging the way to microfinance from larger institutions.

Measuring social impact

Investors receive semi-annual updates on the jobs and businesses created and sustained on the back of their EIF loans.

To speak to us about how you can donate to the EIF and provide credit to entrepreneurs, please contact Stephanie (below). If you are a Kenyan national seeking information about joining our training, launching a business and growing your business using our fund, please visit the Hand in Hand Eastern Africa website.

Get in touch

EIF

Stephanie Nicholson Head of Finance and ComplianceStephanie joined Hand in Hand International in September 2017. Previously, she worked as a Management Consultant at Accenture, with a focus on financial management for global cost reduction and organisational change programmes.

snicholson@hihinternational.org